Contrasting Trends in Mainstream Cannabis Products & Oils: US vs Canadian Markets

As the cannabis industry continues to evolve, the differences between the US and Canadian markets become increasingly apparent. From regulatory landscapes to consumer preferences, each market offers unique opportunities and challenges. In this article, we delve into the variations in mainstream cannabis products and oils, focusing on the distinctions between THC and Delta-8-THC, and how they manifest in the US and Canadian markets.

Mainstream Products (vaporization devices):

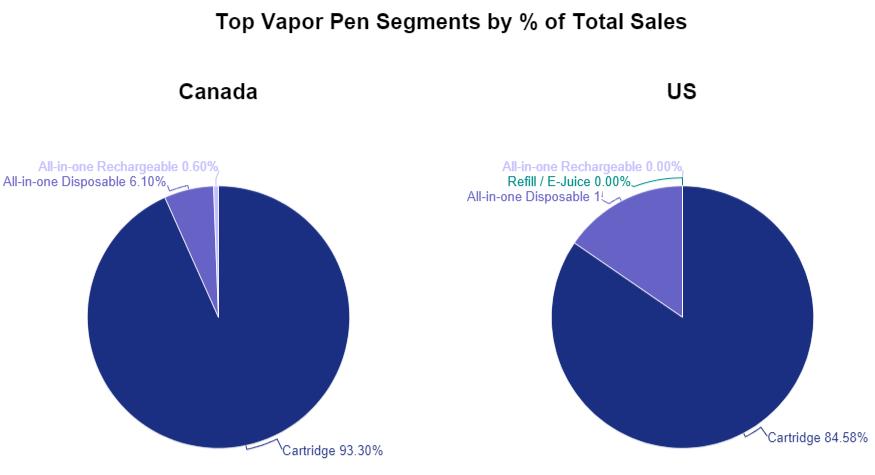

In the United States, disposable vape pens (15.40%), cartridges (84.50%), and pods reign supreme. Consumers appreciate the convenience and potency of these products, often opting for high-THC formulations to achieve desired effects. Additionally, the emergence of Delta-8-THC products is gaining traction, offering a milder psychoactive experience and catering to consumers seeking alternative options amidst varying state regulations.Conversely, the Canadian market showcases a preference for cartridges (93.30%), oil drops, and tinctures. While high-THC oils are prevalent, regulatory constraints often lead to smaller capacities in vape devices, ensuring compliance and consumer safety. The focus remains on quality and consistency, with stringent regulations guiding product development and distribution.

Differences in Cannabis Oils (THC and Δ8-THC):

United States:

● Legality of THC: In most states of the US, Δ9-THC is legal, especially in medical cannabis markets and some recreational cannabis markets. However, legality varies by state, and some still consider it illegal.

● Rise of Δ8-THC: In recent years, Δ8-THC has gained attention as a legal cannabis derivative. While its psychoactive effects are relatively mild compared to Δ9-THC, its legality contributes to its promotion in some markets.

● Market Demand: There is strong demand in the US market for various THC products, including high-potency Δ9-THC products and increasingly popular Δ8-THC products. Consumers have diverse needs for different types and strengths of THC products.

Canada:

● Legality of THC: Canada's cannabis laws legalize Δ9-THC but are stricter in regulation. Cannabis products must be sold through compliant production and distribution channels, and Δ9-THC content needs to be within statutory limits.

● Legal Status of Δ8-THC: Canada's legal framework has not explicitly defined the legality of Δ8-THC, making its status relatively uncertain. This ambiguity may affect the supply and consumption of Δ8-THC products in the market.

● Market Trends: Although Canada's cannabis market is relatively smaller, consumers still have demand for high-quality cannabis products and diverse choices. With market development and increased consumer awareness, there may be a demand for a wider variety of THC products.

In conclusion, THC and Delta-8-THC represent distinct compounds with differing chemical structures and effects. In the US,Delta-8-THC is often perceived as having a lower psychoactive effect compared to THC, which has contributed to its increasing demand. This milder psychoactive effect appeals to consumers who are seeking a more subtle or less intense experience with cannabis products. Additionally, as demand for Delta-8-THC increases, there's also a trend towards larger capacity devices.

Consumers may opt for larger devices to accommodate their consumption preferences, whether it's for personal use or sharing with others.

In Canada, high-THC oils remain popular, reflecting a longstanding cannabis culture rooted in potency and efficacy. However,regulatory oversight mandates adherence to strict quality standards, ensuring product safety and consistency. While Delta-8-THCproducts may emerge, they face scrutiny within a tightly regulated market environment. Furthermore, the THC content of cannabis oil or extracts is usually limited to less than 0.30%, so most vaporization devices available on the market typically have a capacity of 1.0ml or less. The majority of them are designed with capacities of either 0.5ml or 1.0ml to accommodate the consumption preferences of users.